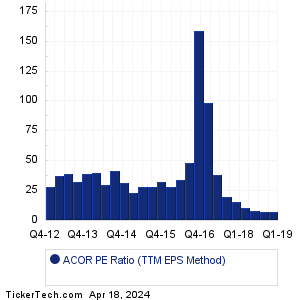

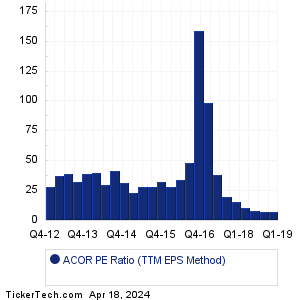

This ACOR PE ratio history page last updated 4/18/2024

This ACOR PE ratio history page last updated 4/18/2024

|

| Period | Price | Earnings | TTM | PE |

|---|

Q3 2023

11/13/2023 | 9.57 | -7.16 | -17.11 | NA | Q2 2023

8/8/2023 | 16.50 | -7.55 | -20.95 | NA | Q1 2023

5/11/2023 | 16.80 | -13.80 | -76.40 | NA | Q4 2022

3/9/2023 | 16.20 | 11.40 | -95.80 | NA | Q3 2022

11/1/2022 | 16.00 | -11.00 | -120.60 | NA | Q2 2022

8/4/2022 | 10.60 | -63.00 | -138.20 | NA | Q1 2022

5/11/2022 | 14.80 | -33.20 | -112.60 | NA | Q4 2021

3/9/2022 | 45.00 | -13.40 | -128.60 | NA | Q3 2021

11/9/2021 | 75.20 | -28.60 | -165.20 | NA | Q2 2021

8/5/2021 | 82.00 | -37.40 | -164.20 | NA | Q1 2021

5/6/2021 | 94.20 | -49.20 | -168.80 | NA | Q4 2020

3/4/2021 | 135.60 | -50.00 | -180.80 | NA | Q3 2020

11/3/2020 | 129.60 | -27.60 | -148.80 | NA | Q2 2020

8/4/2020 | 76.80 | -42.00 | -176.40 | NA | Q1 2020

5/5/2020 | 112.80 | -61.20 | -200.40 | NA | Q4 2019

2/13/2020 | 230.40 | -18.00 | -206.40 | NA | Q3 2019

11/4/2019 | 240.00 | -55.20 | -134.40 | NA | Q2 2019

8/1/2019 | 728.40 | -66.00 | -58.80 | NA | Q1 2019

5/2/2019 | 1269.60 | -67.20 | 175.20 | 7.2 | Q4 2018

2/14/2019 | 1867.20 | 54.00 | 259.20 | 7.2 | Q3 2018

10/31/2018 | 2293.20 | 20.40 | 278.40 | 8.2 | Q2 2018

8/2/2018 | 3120.00 | 168.00 | 309.60 | 10.1 | Q1 2018

5/2/2018 | 2784.00 | 16.80 | 176.40 | 15.8 | Q4 2017

2/15/2018 | 3012.00 | 73.20 | 150.00 | 20.1 | Q3 2017

10/31/2017 | 3189.60 | 51.60 | 82.80 | 38.5 | Q2 2017

7/27/2017 | 2604.00 | 34.80 | 26.40 | 98.6 | Q1 2017

4/27/2017 | 1866.00 | -9.60 | 0.00 | >500 | Q4 2016

2/14/2017 | 2862.00 | 6.00 | 18.00 | 159.0 | Q3 2016

10/27/2016 | 2190.00 | -4.80 | 45.60 | 48.0 | Q2 2016

7/28/2016 | 2994.00 | 8.40 | 87.60 | 34.2 | Q1 2016

4/28/2016 | 3280.80 | 8.40 | 116.40 | 28.2 | Q4 2015

2/11/2016 | 4017.60 | 33.60 | 126.00 | 31.9 | Q3 2015

10/22/2015 | 4190.40 | 37.20 | 147.60 | 28.4 | Q2 2015

7/30/2015 | 4107.60 | 37.20 | 144.00 | 28.5 | Q1 2015

4/30/2015 | 3608.40 | 18.00 | 157.20 | 23.0 | Q4 2014

2/12/2015 | 4398.00 | 55.20 | 141.60 | 31.1 | Q3 2014

10/30/2014 | 4338.00 | 33.60 | 104.40 | 41.6 | Q2 2014

7/31/2014 | 3512.40 | 50.40 | 116.40 | 30.2 | Q1 2014

5/6/2014 | 3824.40 | 2.40 | 96.00 | 39.8 | Q4 2013

2/13/2014 | 4087.20 | 18.00 | 104.40 | 39.1 | Q3 2013

10/31/2013 | 3673.20 | 45.60 | 115.20 | 31.9 | Q2 2013

8/1/2013 | 4471.20 | 30.00 | 115.20 | 38.8 | Q1 2013

5/2/2013 | 4363.20 | 10.80 | 117.60 | 37.1 | Q4 2012

2/13/2013 | 3595.20 | 28.80 | 129.60 | 27.7 | Q3 2012

10/31/2012 | 2874.00 | 45.60 | NA | NA | Q2 2012

7/31/2012 | 2888.40 | 32.40 | NA | NA | Q1 2012

5/3/2012 | 2878.80 | 22.80 | NA | NA |

|

|

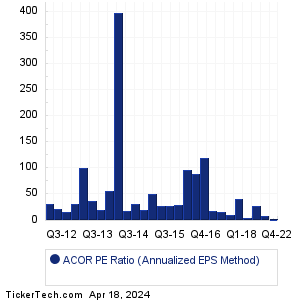

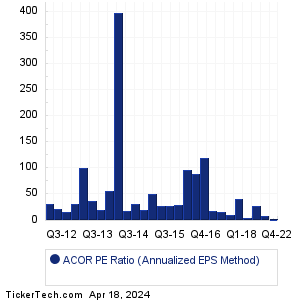

| Period | Price | Earnings | Annualized | PE |

|---|

Q3 2023

11/13/2023 | 9.57 | -7.16 | -28.64 | NA | Q2 2023

8/8/2023 | 16.50 | -7.55 | -30.20 | NA | Q1 2023

5/11/2023 | 16.80 | -13.80 | -55.20 | NA | Q4 2022

3/9/2023 | 16.20 | 11.40 | 45.60 | 0.4 | Q3 2022

11/1/2022 | 16.00 | -11.00 | -44.00 | NA | Q2 2022

8/4/2022 | 10.60 | -63.00 | -252.00 | NA | Q1 2022

5/11/2022 | 14.80 | -33.20 | -132.80 | NA | Q4 2021

3/9/2022 | 45.00 | -13.40 | -53.60 | NA | Q3 2021

11/9/2021 | 75.20 | -28.60 | -114.40 | NA | Q2 2021

8/5/2021 | 82.00 | -37.40 | -149.60 | NA | Q1 2021

5/6/2021 | 94.20 | -49.20 | -196.80 | NA | Q4 2020

3/4/2021 | 135.60 | -50.00 | -200.00 | NA | Q3 2020

11/3/2020 | 129.60 | -27.60 | -110.40 | NA | Q2 2020

8/4/2020 | 76.80 | -42.00 | -168.00 | NA | Q1 2020

5/5/2020 | 112.80 | -61.20 | -244.80 | NA | Q4 2019

2/13/2020 | 230.40 | -18.00 | -72.00 | NA | Q3 2019

11/4/2019 | 240.00 | -55.20 | -220.80 | NA | Q2 2019

8/1/2019 | 728.40 | -66.00 | -264.00 | NA | Q1 2019

5/2/2019 | 1269.60 | -67.20 | -268.80 | NA | Q4 2018

2/14/2019 | 1867.20 | 54.00 | 216.00 | 8.6 | Q3 2018

10/31/2018 | 2293.20 | 20.40 | 81.60 | 28.1 | Q2 2018

8/2/2018 | 3120.00 | 168.00 | 672.00 | 4.6 | Q1 2018

5/2/2018 | 2784.00 | 16.80 | 67.20 | 41.4 | Q4 2017

2/15/2018 | 3012.00 | 73.20 | 292.80 | 10.3 | Q3 2017

10/31/2017 | 3189.60 | 51.60 | 206.40 | 15.5 | Q2 2017

7/27/2017 | 2604.00 | 34.80 | 139.20 | 18.7 | Q1 2017

4/27/2017 | 1866.00 | -9.60 | -38.40 | NA | Q4 2016

2/14/2017 | 2862.00 | 6.00 | 24.00 | 119.2 | Q3 2016

10/27/2016 | 2190.00 | -4.80 | -19.20 | NA | Q2 2016

7/28/2016 | 2994.00 | 8.40 | 33.60 | 89.1 | Q1 2016

4/28/2016 | 3280.80 | 8.40 | 33.60 | 97.6 | Q4 2015

2/11/2016 | 4017.60 | 33.60 | 134.40 | 29.9 | Q3 2015

10/22/2015 | 4190.40 | 37.20 | 148.80 | 28.2 | Q2 2015

7/30/2015 | 4107.60 | 37.20 | 148.80 | 27.6 | Q1 2015

4/30/2015 | 3608.40 | 18.00 | 72.00 | 50.1 | Q4 2014

2/12/2015 | 4398.00 | 55.20 | 220.80 | 19.9 | Q3 2014

10/30/2014 | 4338.00 | 33.60 | 134.40 | 32.3 | Q2 2014

7/31/2014 | 3512.40 | 50.40 | 201.60 | 17.4 | Q1 2014

5/6/2014 | 3824.40 | 2.40 | 9.60 | 398.4 | Q4 2013

2/13/2014 | 4087.20 | 18.00 | 72.00 | 56.8 | Q3 2013

10/31/2013 | 3673.20 | 45.60 | 182.40 | 20.1 | Q2 2013

8/1/2013 | 4471.20 | 30.00 | 120.00 | 37.3 | Q1 2013

5/2/2013 | 4363.20 | 10.80 | 43.20 | 101.0 | Q4 2012

2/13/2013 | 3595.20 | 28.80 | 115.20 | 31.2 | Q3 2012

10/31/2012 | 2874.00 | 45.60 | 182.40 | 15.8 | Q2 2012

7/31/2012 | 2888.40 | 32.40 | 129.60 | 22.3 | Q1 2012

5/3/2012 | 2878.80 | 22.80 | 91.20 | 31.6 |

|

On this page we presented the ACOR PE Ratio History information for Acorda Therapeutics' stock.

The average ACOR PE ratio history based on using the annualized quarterly earnings result at each measurement period (for the "E" in the PE calculation; and the closing price on earnings date as the "P") is 50.1. Meanwhile, using the trailing twelve month (TTM) quarterly earnings result as our method of calculation the "E" value at each measurement period, the average ACOR PE ratio history based on this TTM earnings result method is 38.2. Note: any PE calculations resulting in a value exceeding 500 were discarded as not meaningful. Note: any PE calculations involving negative earnings were discarded as not meaningful.

Let's now compare this ACOR PE ratio history result, against the recent PE: when this page was posted on 4/11/2024, the most recent closing price for ACOR had been 0.66, and the most recent quarterly earnings result, annualized, was 45.6. Meanwhile, the most recent TTM earnings summed to 175.2. From these numbers, we calculate the recent ACOR PE on 4/11/2024 based on annualized quarterly EPS was 0.0. Based on ACOR's history, that recent PE is low relative to the historical average, with the recent PE 100.0% lower than the historical average PE across our data set for Acorda Therapeutics. Looking at the recent ACOR PE on 4/11/2024 based on TTM EPS, we calculate the ratio at 0.0. Based on ACOR's history, that recent PE is low relative to the historical average, with the recent PE 100.0% lower than the average PE across our Acorda Therapeutics data set with TTM EPS used in the calculation at each period.

For self directed investors doing their due diligence on ACOR or any other given stock, valuation analysis for ACOR

can greatly benefit from studying the past earnings and resulting PE ratio history calculations. This type of study can

help inform an analysis as to whether the earnings trajectory over time and current versus historical average PE ratios

justify the current stock market value.

That's why we bring you HistoricalPERatio.com to make it easy for investors to investigate

Acorda Therapeutics PE ratio history — or the PE history for any stock in our coverage universe.

And in your continued research we hope you will be sure to check out the further links included for

next earnings dates and also historical earnings surprises history for ACOR. Thanks for visiting, and the next

time you need to research ACOR PE Ratio History or the PE ratio history for another stock, we hope our site

will come to mind as your go-to PE ratio history research resource of choice.